What If I Cannot Afford To Pay My Taxes When Due?

First off, if you cannot afford to pay your tax bill, do not panic. There are options available but there are some key things you want to ensure you are doing. What Do I Need To Know If I Cannot Afford To Pay My Tax Bill? Make sure at a minimum you complete a few […]

Is It Fine To File An Extension And What Do I Need To Know About Tax Extensions?

It is that time of the year where we start to get a lot of questions around extensions and there are a lot of mis information out there so we want to try and clear all those up in this article. Is It Fine To File An Extension? We hear from so many business owners […]

Can I Have A Home Office If I Have Another Office?

COVID brought along this new way of working for so many businesses that in the past may have said they are never going virtual. One question that we have seen a lot is around if a business owner can take a home office deduction even if they have another office away from home. That is […]

American Rescue Plan Act – What Do I Need To Know?

There has now been around $6 trillion in economic relief during the pandemic thus far. Yes, $6 trillion. That number includes the recently passed American Rescue Plan Act (ARP) which account for $1.9 trillion. Our goal here is to breakdown the important pieces of the Act that you need to know about. American Rescue Plan […]

Do I Need To File A Tax Return (Personal or Business)?

This is a question we get a done, especially from new business owners, do I even need to file a tax return? In this article we are going to break that down exactly so you know when you need to file a return, whether that be for you personally or your business. Do I Need […]

Unlock Tax Savings: The Augusta Rule – Your Guide to 14-Day Tax-Free Home Rentals

Do you use your home for business events such as shareholder meetings, team retreats, client meetings, employee meetings, etc? If so, this is one tax strategy you definitely want to be check out! The 14 Day Home Rental / Augusta Rule is a piece of the tax code that allows you to potentially shift taxable […]

What Are Some Advanced Retirement Plan Options For High-Income Earners?

Are you a high income earner that is looking to take retirement plan a big step further? If so, this may be something you want to look into. I would highly recommend as a high income earner that you schedule a consult with us before making any decisions so we can ensure you have the […]

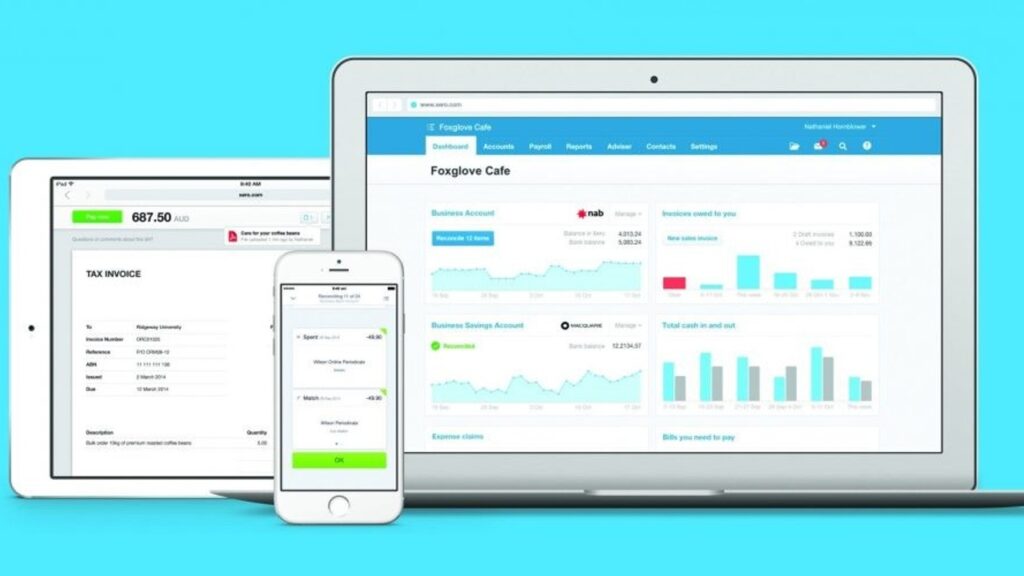

Utilizing Xero For Receipt Tracking

Sick and tired of keeping paper receipts on file for years upon years? Xero has functionality to keep track of receipts directly in your books. If you have a transaction that has already been booked you can go into the Xero app and upload the receipt for it. If you have a receipt that has […]

What Is a Safe Harbor 401k or QACA Safe Harbor 401k?

When we are working with businesses that are leaning towards the 401k route we traditionally see them organize into a Safe Harbor 401k or QACA Safe Harbor 401k. What Is A Safe Harbor 401k? A Safe Harbor 401(k) plan is a type of 401(k) with an employer match that allows you to avoid most annual compliance tests. […]

What Is a Traditional 401k For Businesses?

When we are working with businesses that have employees and want to setup a more robust retirement option with more flexibility we look at a couple options: Traditional 401k – Discussed in this article Safe Harbor 401k or QACA Safe Harbor 401k – Discussed in next article What Is a Traditional 401k and What Do […]